XYZ Company sells their business to ABC Company. Do you send COBRA notices or not? This was a common occurrence at SBA in 2016 for some reason. And, I was asked this question twice this week so I thought this might be something worth sharing.

If this, then that…

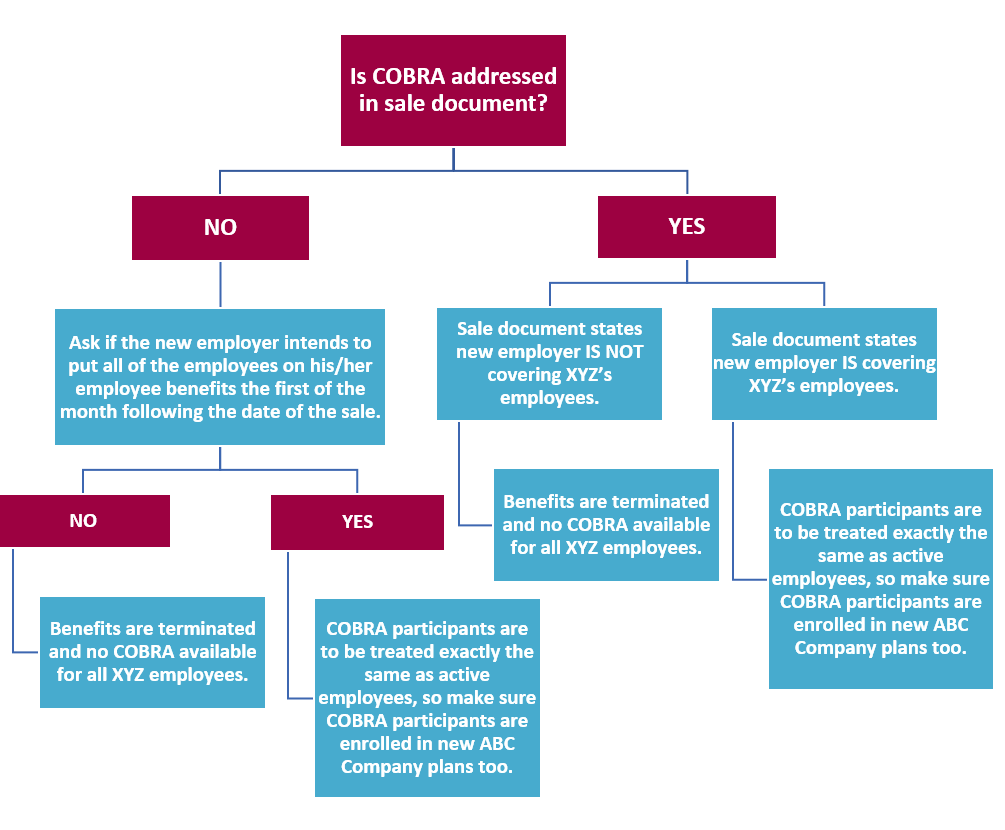

The quickest way to figure out what’s happening to employees and COBRA participants of XYZ Company is to ask if the COBRA responsibility is addressed in the legal sale document.

And, please note: when the insurance contracts (medical, dental vision, etc.) of XYZ Company terminate, COBRA notices are NOT mailed to anyone because “you can’t CONTINUE on a terminated benefit.”

What if’s

- What if the new employer is not going to bring on employees of XYZ Company?

- What if the new employer hires some but not all, of the employees of XYZ Company and makes them meet the new hire eligibility requirements rather than automatically enrolling them onto the new employer’s benefits with special enrollment rights?

In either of these cases, it’s just like a termination of employment for all the employees of XYZ Company. And, again, when the insurance contracts (medical, dental vision, etc.) of XYZ Company terminate, COBRA notices are NOT mailed to anyone because “you can’t CONTINUE on a terminated benefit.” Notice a trend here?

What can an XYZ employee losing coverage do?

One actual nice thing about the Affordable Care Act is that ex-employees can buy individual insurance on the State or Federal Exchange (depending on what state they live in) because they have had a mid-year qualifying event due to their termination of employment. The tricky thing is that proper documentation of the event is required if no COBRA notice is mailed. XYZ Company needs to issue each terminated employee a letter with the following required information:

The letter must:

- Be on company letterhead

- Identify the names of each family member who was covered on insurance

- State the reason for the loss of benefits: Sale of company and termination of all employee benefits

- State the date insurance coverage ended

What if it’s not all or nothing?

There are cases when XYZ Company decides to keep a skeleton crew on staff to wrap up the affairs of the company. And so, when the insurance contracts are kept in place for one, two or three months after the sale to keep that skeleton crew insured during this time, then COBRA notices ARE mailed to every terminated employee. They can elect to CONTINUE benefits because the benefits have not yet been terminated.

However, once benefits are terminated, even after only 1, 2 or 3 months, anyone enrolled on COBRA will be treated as having completed the entire COBRA eligibility period (normally 18 months). At that time, be sure to send a “Termination of COBRA – End of Eligibility Notice.” Employees can then use this notice as documentation to get an individual insurance policy or State/Federal Exchange policy mid-year.

With everything COBRA there are a lot of if’s, and’s and but’s, so when faced with a merger or acquisition make sure you are asking all the probing questions to determine who, what and when a COBRA notice is applicable. And, as always, feel free to call me with questions!

– Gina